Introduction: Visualizing the Economic Engine

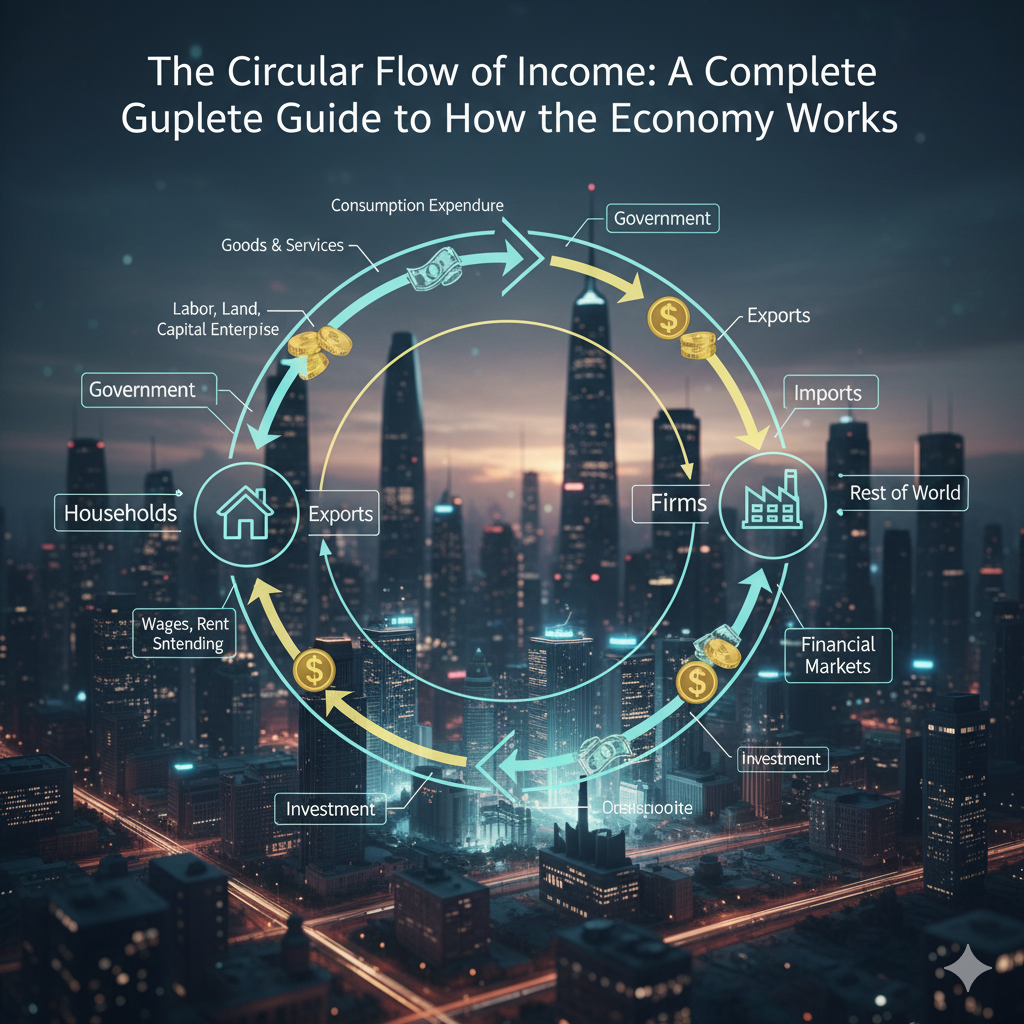

Think of an economy as a living organism. Just as a body relies on the constant circulation of blood to deliver nutrients and remove waste, an economy relies on the constant circulation of money. This flow is the lifeblood of economic activity, connecting every individual, business, and institution in a complex, unending dance of production, income, and spending.

To understand this intricate system, economists use a powerful conceptual map: the Circular Flow of Income model. This model provides a simplified but profound illustration of how money moves through the different sectors of an economy.1 It strips away the overwhelming complexity of the real world to reveal the fundamental relationships that govern our economic lives.

At its core, the model demonstrates the interdependence of all economic players and establishes a crucial identity: the total value of goods and services produced (Output) must equal the total amount spent to buy them (Expenditure), which in turn must equal the total income earned from producing them (Income).3 This principle is the bedrock of macroeconomics and the foundation for how we measure a nation’s economic health. This guide will build this model from the ground up, starting with a simple two-player economy and gradually adding layers of complexity to reveal a surprisingly accurate picture of how our modern economy functions.

The Foundation: The Simple Two Sector Model

To begin, we imagine the simplest possible economy, one consisting of only two key players: Households and Firms. This is the two-sector model, and it forms the foundation of our understanding.4

- Households: This sector represents all individuals and groups who share their income. In the economy, they play a dual role. First, they are the ultimate owners of all the resources, or factors of production: land, labor, capital (machinery, tools), and entrepreneurship. Second, they are the consumers who buy the goods and services the economy produces.5

- Firms: This sector includes all organizations that produce goods and services for sale. To do this, they must purchase the factors of production from households.5

In this simplified model, we make a few key assumptions: it’s a closed economy with no government interference, no financial sector, and, most importantly, households spend every dollar they earn.4 Within this framework, two distinct flows emerge, moving in opposite directions but perfectly balanced in value.

The Dual Flows

- The Real Flow (Physical Flow): This is the flow of actual things—resources and products. It moves in a counter-clockwise direction in our diagram. Households supply their factors of production to firms through the Factor Market (also called the resource market). Firms then use these resources to produce goods and services, which flow back to households via the Product Market.8 For example, you provide your labor (a factor of production) to a company, and in return, the company produces a smartphone (a good) that you can buy.

- The Money Flow (Nominal Flow): This is the flow of money, which moves in the opposite, clockwise direction. In the Factor Market, firms pay households for their resources. These factor payments take the form of wages (for labor), rent (for land), interest (for capital), and profit (for entrepreneurship). This entire stream of payments constitutes the households’ income. Households then take this income and spend it in the Product Market, an act known as consumption expenditure. This spending becomes the revenue for the firms, allowing them to continue buying resources and producing goods.2

This simple model reveals two profound truths. First, every dollar of expenditure is simultaneously a dollar of income. Your spending at a coffee shop is the barista’s income, which they then use to pay their rent, making it their landlord’s income. This is the fundamental identity that makes measuring the economy possible.4 Second, it clarifies the two primary markets that organize economic activity: the Factor Market, where households sell and firms buy, and the Product Market, where firms sell and households buy.8

Adding Complexity: The Critical Role of Leakages and Injections

The two-sector model is a powerful starting point, but its assumption that households spend all their income is unrealistic. In the real world, money is constantly being removed from or added to this primary flow between households and firms. These movements are known as leakages and injections, and they are the forces that cause an economy to expand and contract.4

- Leakages (or Withdrawals): These are flows of money that leave the main circular flow, reducing the total amount of spending and, therefore, the size of the economy. When money is put into a leakage, it is not being used for immediate consumption on domestically produced goods and services.4 The three main leakages are:

- Savings (S): Income that households choose not to spend, instead depositing it in financial institutions like banks.5

- Taxes (T): Money collected by the government from both households and firms.5

- Imports (M): Spending by domestic households and firms on goods and services produced in foreign countries.5

- Injections: These are additions of spending into the circular flow that come from outside the core household consumption stream. Injections increase the total amount of spending and boost the size of the economy.4 The three main injections are:

- Investment (I): Spending by firms on capital goods like new machinery, equipment, and factories. This spending is typically financed by borrowing from financial institutions.5

- Government Spending (G): Spending by the government on public goods and services (like infrastructure and defense) and transfer payments (like social security benefits).5

- Exports (X): Spending by foreign households and firms on goods and services produced domestically.5

These concepts are crucial because they connect individual choices to macroeconomic outcomes. A household’s decision to save more money is a leakage. A business’s decision to build a new factory is an injection. The overall health of the economy depends on the balance between the aggregate of all leakages and all injections.10 Furthermore, each leakage has a corresponding injection, but they are often made by different groups for different reasons. Households save, but firms invest. People pay taxes, but the government spends. This disconnect is a primary source of economic fluctuations.12

Building the Modern Economy: From Three to Five Sectors

Using the concepts of leakages and injections, we can now build a more realistic model of the economy by adding three more sectors one by one: the financial sector, the government sector, and the foreign sector.13

The Three Sector Model: Introducing the Financial Sector

The first step toward realism is to acknowledge that households do not spend all their income; they save some of it. This brings the Financial Sector into our model. This sector is composed of institutions like banks that act as intermediaries, channeling funds from savers to borrowers.9

- Leakage: Households deposit their Savings (S) into the financial sector. This money is a leakage because it is withdrawn from the consumption flow.12

- Injection: The financial sector then lends this money to firms, which use it for Investment (I) in new capital. This spending on capital goods is an injection back into the circular flow.12

The Four Sector Model: Adding the Government

Next, we introduce the Government Sector. This creates what is often called a “closed economy” model, as it includes all domestic activity but still excludes international trade.14 The government plays a powerful role by collecting taxes and making expenditures.

- Leakage: The government levies Taxes (T) on both households and firms. This money is a leakage because it reduces the disposable income available for consumption and the funds available for investment.14

- Injection: The government uses its tax revenue to fund Government Spending (G). This includes purchasing goods and services from firms (e.g., building roads, buying military equipment) and making transfer payments to households (e.g., unemployment benefits), all of which inject money back into the flow.14

The Five Sector Model: Opening to the World

Finally, to create a complete and realistic picture of a modern economy, we add the Foreign Sector (also called the “rest of the world”). This transforms our diagram into a five-sector, “open economy” model that accounts for international trade and financial flows.17

- Leakage: When domestic households and firms buy goods and services from other countries, this is called Imports (M). The money spent on imports is a leakage because it flows out of the domestic economy to foreign producers.17

- Injection: When foreign countries buy domestically produced goods and services, this is called Exports (X). The revenue earned from exports is an injection because it represents money flowing into the domestic economy from abroad.17

To consolidate these concepts, the relationship between the sectors and their corresponding leakages and injections can be summarized as follows:

| Sector | Leakage (Withdrawal from the Flow) | Injection (Addition to the Flow) |

| Financial Sector | Savings (S) | Investment (I) |

| Government Sector | Taxes (T) | Government Spending (G) |

| Foreign Sector | Imports (M) | Exports (X) |

The Economy at Rest (and in Motion): The Concept of Equilibrium

With all sectors in place, we can now define the condition for a stable economy. An economy is said to be in equilibrium when the total value of all leakages is exactly equal to the total value of all injections.18 At this point, the amount of money being withdrawn from the circular flow is perfectly balanced by the amount of money being added, and the overall level of national income remains constant.18

The equilibrium condition can be expressed with a simple formula:

S + T + M = I + G + X

However, the economy is often in a state of disequilibrium, where these two forces are not balanced. The consequences depend on which side is greater:

- Injections > Leakages (I + G + X > S + T + M): When more money is being injected into the economy than is leaking out, total spending exceeds total income. Firms respond to this high demand by increasing production, which requires hiring more workers. This leads to rising national income, falling unemployment, and overall economic expansion or growth. If this expansion is too rapid, it can also lead to inflation.10

- Leakages > Injections (S + T + M > I + G + X): When more money is leaking out of the economy than is being injected, total income exceeds total spending. Firms find their inventories piling up and respond by cutting back on production and laying off workers. This leads to falling national income, rising unemployment, and an economic contraction or recession.20

This framework reveals that the goal of macroeconomic policy is often to manage injections and leakages to guide the economy toward a stable equilibrium at a desirable level, such as full employment.19 For instance, during a recession (when leakages exceed injections), a government can use fiscal policy to increase government spending (G, an injection) or cut taxes (T, reducing a leakage) to stimulate the circular flow.10

The equilibrium equation can also be rearranged to reveal a powerful identity that links all sectors of the economy: (S – I) = (G – T) + (X – M).22 This shows that a country’s private sector net savings (S – I) must be used to finance the government’s budget deficit (G – T) and its trade surplus (X – M).

The Ultimate Scorecard: How the Circular Flow Defines GDP

The circular flow model is not just a theoretical diagram; it is the conceptual foundation for measuring a nation’s economic output, or Gross Domestic Product (GDP). The model’s core principle—that total production equals total expenditure equals total income—gives rise to the three distinct methods used to calculate GDP.20

- The Expenditure Approach: This is the most common method and directly reflects the spending flows in our model. It calculates GDP by summing up all spending on final goods and services in the economy.24 The formula is a direct representation of the components of spending in the five-sector model:

GDP = C + I + G + (X – M)

Here, C is consumption, I is investment, G is government spending, and (X – M) is net exports. This formula can be seen as the core consumption flow plus the net injections from the other economic sectors.24 - The Income Approach: This method calculates national income by summing all the income earned by the factors of production. This corresponds to the money flow from firms to households in the factor market.24 The formula is:

National Income = Wages + Rent + Interest + Profit

In theory, after some accounting adjustments, this figure should equal GDP calculated by the expenditure approach.24 - The Output (or Value-Added) Approach: This method calculates GDP by summing the value added by each firm at every stage of production. This avoids the error of double-counting intermediate goods (e.g., counting both the value of the steel and the full value of the car made from it) and measures the total value of final goods and services produced by the firm sector.23

The model also helps clarify what is not included in GDP. For example, government transfer payments are not part of G because they are not a payment for a currently produced good or service. Similarly, unpaid work and illegal activities are excluded because they do not flow through the formal markets depicted in the model.27

The Ripple Effect: A Primer on the Multiplier

The circular flow is not a single-lap race; it’s a continuous process where money circulates again and again. This dynamic quality gives rise to one of the most important concepts in macroeconomics: the multiplier effect.

The multiplier effect describes how an initial injection of spending into the economy leads to a much larger final increase in national income.28 The mechanism is simple: one person’s spending becomes another person’s income. That person then spends a portion of their new income, which becomes income for a third person, and so on. This creates a ripple effect that magnifies the impact of the initial spending.30

The size of this ripple depends on how much of each new dollar of income is spent versus saved (or lost to other leakages). The key variable is the Marginal Propensity to Consume (MPC), which is the fraction of any additional income that a household chooses to spend.31 In a simple model with only saving as a leakage, the formula for the multiplier is:

Multiplier =1 /(1 – MPC) or 1 / MPS

where MPS is the Marginal Propensity to Save (1 – MPC).32

For example, assume the government decides to build a new bridge, injecting $100 million into the economy. The construction workers who receive this money have an MPC of 0.8, meaning they spend 80% ($80 million) and save 20% ($20 million). This $80 million is spent at local businesses, becoming income for shopkeepers. They, in turn, spend 80% of that ($64 million), and the process continues.

To calculate the total impact, we use the multiplier formula: Multiplier = 1 / (1 – 0.8) = 1 / 0.2 = 5. The initial $100 million injection is multiplied by 5, leading to a total increase in national income of $500 million.34 In a more realistic open economy, the multiplier is smaller because taxes and imports also act as leakages. The formula becomes:

Multiplier =1 / (MPS + MPT + MPM)

where MPT is the marginal propensity to tax and MPM is the marginal propensity to import.36

Crucially, the multiplier effect works in both directions. A $100 million cut in government spending or business investment can trigger a “reverse multiplier,” leading to a much larger final drop in GDP. This helps explain why recessions can be so severe, as initial spending cuts lead to job losses, which lead to further spending cuts in a vicious downward spiral.31

Conclusion: Why This Simple Circle is a Powerful Idea

The Circular Flow of Income model is far more than a simple diagram. It is an essential tool that takes us from a basic understanding of economic interactions to a sophisticated framework for macroeconomic analysis. It visually establishes the fundamental identity of production, income, and expenditure that underpins all national accounting. It provides an intuitive and powerful language—of injections and leakages—to analyze the causes of economic growth, recessions, and inflation.

By showing how the different sectors of the economy are inextricably linked, the model clarifies the logic behind fiscal and monetary policy and forms the theoretical basis for measuring GDP. It is the foundation upon which more complex concepts, like the multiplier effect, are built. For anyone seeking to understand how the modern economy works, the journey begins with this simple, powerful circle.

Works cited

- Circular Flow Model: Definition and Calculation – Investopedia, accessed October 25, 2025, https://www.investopedia.com/terms/circular-flow-of-income.asp

- Circular Flow of Income in a Two-Sector Economy – BYJU’S, accessed October 25, 2025, https://byjus.com/commerce/circular-flow-of-income-and-methods-of-calculating-national-income/

- www.khanacademy.org, accessed October 25, 2025, https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/economic-iondicators-and-the-business-cycle/21/a/the-circular-flow-and-gdp#:~:text=A%20model%20called%20the%20circular,direction%2C%20in%20a%20closed%20loop.

- Circular flow of income – Wikipedia, accessed October 25, 2025, https://en.wikipedia.org/wiki/Circular_flow_of_income

- IB Economics – The Circular Flow of Income Model | Reference …, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/ib-economics-the-circular-flow-of-income-model

- Circular flow of Income -Two sector model | PPTX – Slideshare, accessed October 25, 2025, https://www.slideshare.net/slideshow/circular-flow-of-income-two-sector-model/55625718

- Two Sector Model – Circular Flow of Income – YouTube, accessed October 25, 2025, https://www.youtube.com/watch?v=4kOJfaygEh8

- Circular Flow | Video Assignment – Federal Reserve Education, accessed October 25, 2025, https://www.federalreserveeducation.org/teaching-resources/economics/gdp/circular-flow

- Circular Flow of Income in two and four sector economy. – SILAPATHAR COLLEGE, accessed October 25, 2025, https://silapatharcollege.edu.in/online/attendence/classnotes/files/1622634262.pdf

- 2.4.2 Injections and Withdrawals | Reference Library | Economics …, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/2-4-2-injections-and-withdrawals

- The Five Sector Model (Circular Flow of Income) and economic growth – MR SYMONDS, accessed October 25, 2025, https://www.mrsymonds.com/blog/the-five-sector-model-circular-flow-of-income-and-economic-growth

- Circular Flow of Income: 2 Sector, 3 Sector and 4 Sector Economy – Economics Discussion, accessed October 25, 2025, https://www.economicsdiscussion.net/circular-flow/circular-flow-of-income-2-sector-3-sector-and-4-sector-economy/10207

- The five sector model (aka the circular flow of income) – MR SYMONDS, accessed October 25, 2025, https://www.mrsymonds.com/blog/the-five-sector-model-aka-the-circular-flow-of-income

- Three Sector Model: Meaning, Assumptions and Diagram | eFM, accessed October 25, 2025, https://efinancemanagement.com/economics/three-sector-model

- Circular Flow of Income in Three Sector Economy – Scribd, accessed October 25, 2025, https://www.scribd.com/document/437439592/Circular-Flow-of-Income-in-Three-Sector-Economy

- Three sector model | PPT – Slideshare, accessed October 25, 2025, https://www.slideshare.net/slideshow/three-sector-model/10600864

- Four Sector Model – Meaning, Assumptions, and More – eFinanceManagement, accessed October 25, 2025, https://efinancemanagement.com/economics/four-sector-model

- Circular Flow of Income: Closed and Open Economies, Injections …, accessed October 25, 2025, https://www.excel-in-economics.com/post/circular-flow-of-income-explained-a-level-igcse-ib-economics

- Equilibrium and disequilibrium (marginal and average propensities not required) – Explaining equilibrium and disequilibrium in the circular flow of income. – Too Lazy To Study, accessed October 25, 2025, https://www.toolazytostudy.com/economics-notes-free-revision/equilibrium-and-disequilibrium-(marginal-and-average-propensities-not-required)-explaining-equilibrium-and-disequilibrium-in-the-circular-flow-of-income.

- AQA EconomicsA-level – Macroeconomics Topic2:How the Macroeconomy Works, Circular Flow of Income, AD – Physics & Maths Tutor, accessed October 25, 2025, https://pmt.physicsandmathstutor.com/download/Economics/A-level/Notes/AQA/Macroeconomics/2-How-the-Macroeconomy-Works-Circular-Flow-of-Income-AD-AS-Analysis-and-Related-Concepts/a)%20The%20circular%20flow%20of%20income.pdf

- Unit 1: Economic links; the 5-sector Circular Flow Model; The business cycle, accessed October 25, 2025, https://study.adrian.id.au/docs/commerce/ch13/unit1

- Four Sector Economy | PDF | Economics – Scribd, accessed October 25, 2025, https://www.scribd.com/document/637474093/FOUR-SECTOR-ECONOMY

- 3.2 Measuring the aggregate economy: Gross domestic product – Macroeconomics, accessed October 25, 2025, https://books.core-econ.org/the-economy/macroeconomics/03-aggregate-demand-02-gross-domestic-product.html

- The Circular Flow Of Income – IB Economics … – Save My Exams, accessed October 25, 2025, https://www.savemyexams.com/dp/economics/ib/22/hl/revision-notes/3-macroeconomics/3-1-measuring-economic-activity/national-income-and-the-circular-flow-of-income/

- 19.1: Measuring Output Using GDP – Social Sci LibreTexts, accessed October 25, 2025, https://socialsci.libretexts.org/Bookshelves/Economics/Introductory_Comprehensive_Economics/Economics_(Boundless)/19%3A_Measuring_Output_and_Income/19.01%3A_Measuring_Output_Using_GDP

- Topic 2.1 Notes – The Circular Flow and GDP (AP Macro) – LumiSource, accessed October 25, 2025, https://www.lumisource.io/ap/macroeconomics/unit2-1/review

- Circular Flow and GDP – AP Macro Study Guide – Fiveable, accessed October 25, 2025, https://fiveable.me/ap-macro/unit-2/circular-flow-gdp/study-guide/zpbpvy3fzRkSgiw1GbV7

- www.tutor2u.net, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/multiplier-effect#:~:text=The%20multiplier%20effect%20occurs%20when,exports%2C%20investment%20or%20government%20spending.

- Explaining the Multiplier Effect | Reference Library | Economics – Tutor2u, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/multiplier-effect

- 3.6 Introducing the multiplier model – Macroeconomics – The Economy 2.0 – CORE Econ, accessed October 25, 2025, https://books.core-econ.org/the-economy/macroeconomics/03-aggregate-demand-06-introducing-multiplier-model.html

- The multiplier effect – Economics Online, accessed October 25, 2025, https://www.economicsonline.co.uk/managing_the_economy/the_multiplier_effect.html/

- www.tutor2u.net, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/2-4-4-the-multiplier#:~:text=Formula%3A,%3D%20MPS%20%2B%20MPT%20%2B%20MPM.

- What Is the Multiplier Effect? Formula and Example – Investopedia, accessed October 25, 2025, https://www.investopedia.com/terms/m/multipliereffect.asp

- www.investopedia.com, accessed October 25, 2025, https://www.investopedia.com/terms/m/multipliereffect.asp#:~:text=For%20example%2C%20if%20consumers%20save,creates%20extra%20spending%20of%20%245.

- Multiplier Effect in Action: How Investments Drive Growth – Tech Help Canada, accessed October 25, 2025, https://techhelp.ca/multiplier-effect/

- Explaining and Calculating the Simple and Extended Multiplier | Reference Library | Economics | tutor2u, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/explaining-and-calculating-the-simple-and-extended-multiplier

- 2.4.4 The Multiplier | Reference Library | Economics – Tutor2u, accessed October 25, 2025, https://www.tutor2u.net/economics/reference/2-4-4-the-multiplier

- Understanding the Multiplier Effect | Key Concept for A Level Economics Tuition, accessed October 25, 2025, https://www.tuitiongenius.com/multiplier-effect

Leave a Reply