Understanding where your money goes is the first step toward financial freedom. In this case study, we’ll walk through three months of real-world transactions, highlight key insights, and offer actionable strategies to improve your budget without feeling deprived.

Historical Budget Analysis

Below is a summary of net income versus expenses from January through March 2025:

| Month | Income | Expenses | Net Change |

|---|---|---|---|

| January 2025 | $7,589.91 | $7,803.55 | –$213.64 |

| February 2025 | $7,378.56 | $7,627.65 | –$249.09 |

| March 2025 | $7,271.07 | $7,840.66 | –$569.59 |

Even with consistent paychecks, expenses outpaced income each month, creating a small but steady deficit.

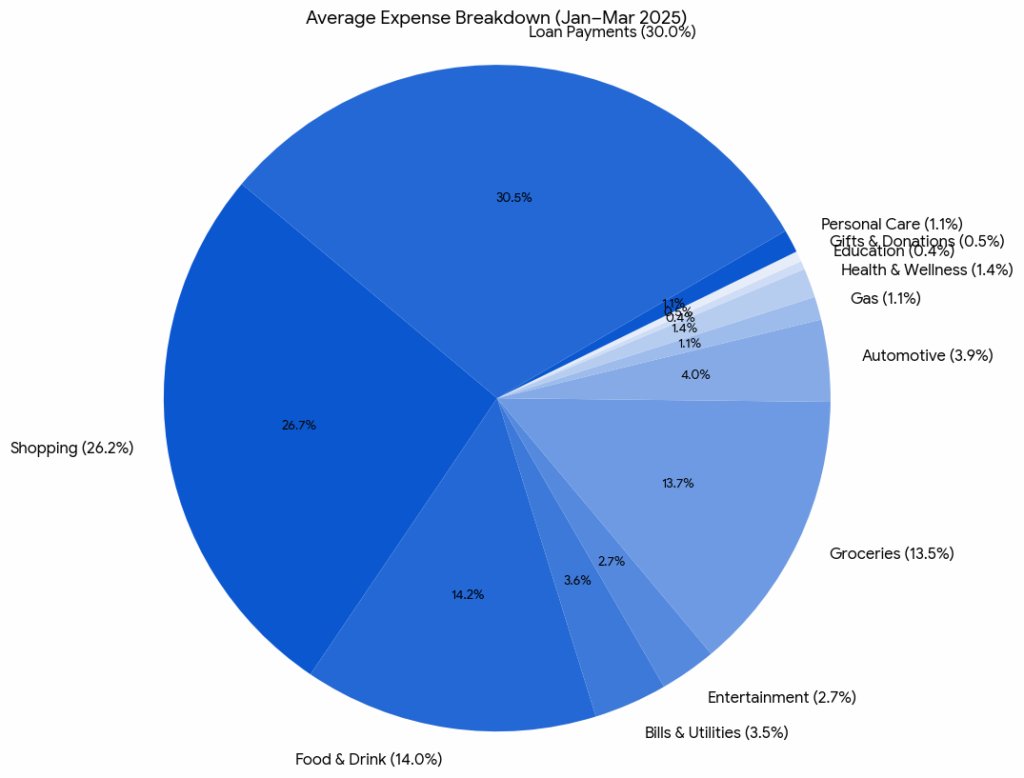

Categorized Spending Trends

Breaking down expenses by category reveals where most dollars flow:

| Category | Jan 2025 | Feb 2025 | Mar 2025 |

|---|---|---|---|

| Shopping | $2,235 | $1,875 | $1,981 |

| Food & Drink | $1,113 | $988 | $1,146 |

| Groceries | $1,109 | $983 | $1,056 |

| Loan Payments | $2,112 | $2,396 | $2,468 |

| Bills & Utilities | $237 | $281 | $294 |

| Entertainment | $185 | $241 | $204 |

| Automotive & Gas | $300 | $418 | $455 |

| Health & Wellness | $93 | $120 | $101 |

| Personal Care | $87 | $75 | $97 |

| Gifts & Donations | $28 | $52 | $38 |

| Education | $103 | $0 | $0 |

Key observations:

- Shopping, Groceries, and Dining make up nearly 50% of expenses.

- Fixed debt payments (credit cards, loans) account for 30% of outflows.

- Variable categories like entertainment and personal care offer room for adjustment.

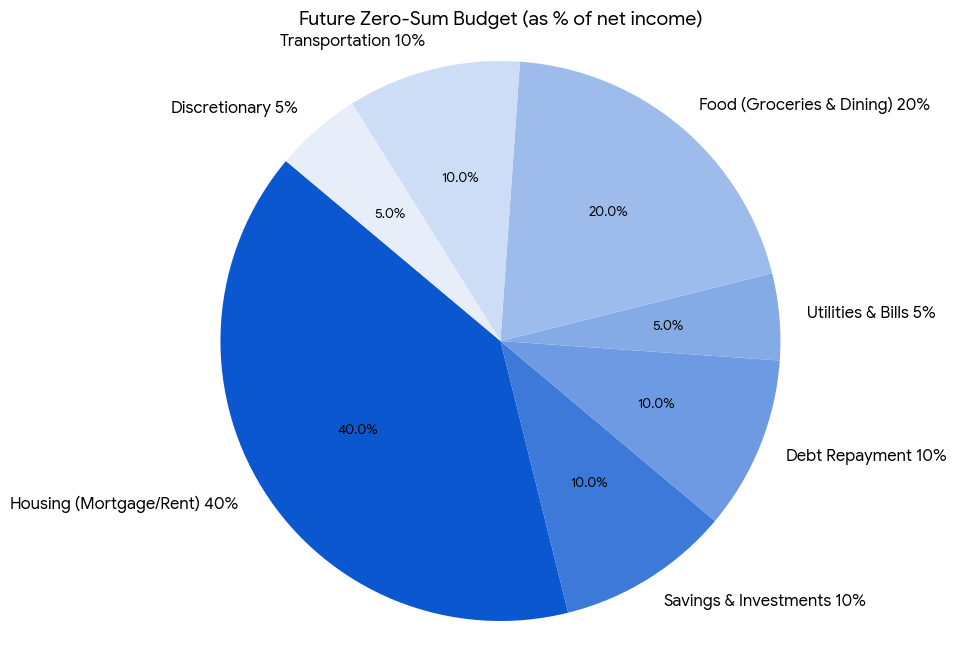

Zero-Sum Budget Proposal

To stop running a deficit and start directing every dollar purposefully, here’s a 100% allocation of your monthly income:

| Category | Percentage |

|---|---|

| Housing (Mortgage / Rent) | 40% |

| Savings & Investments | 10% |

| Debt Repayment (Non-Housing) | 10% |

| Utilities & Bills | 5% |

| Food (Groceries + Dining) | 20% |

| Transportation (Auto + Gas) | 10% |

| Discretionary (Shopping, Etc.) | 5% |

With this framework, you’ll cover essentials, build savings, and cap discretionary spending—zero dollars left unassigned.

5 Effortless Ways to Save

- Automate $50–$100 per paycheck into a high-yield savings account.

- Swap delivery orders for restaurant pickup to cut fees.

- Pause or cancel one underused subscription (streaming, apps).

- Delay non-essential purchases 48 hours—impulses often fade.

- Match spending categories to your highest-reward credit card.

These small tweaks preserve your lifestyle while boosting savings invisibly.

Additional Opportunities

- Subscription Audit: Review recurring charges every quarter.

- Cashback & Rewards: Link grocery and dining to cards with bonus categories.

- Debt Refinancing: Explore lower-rate consolidation for loans or cards.

- Side Hustle Ideas: Monetize your skills on freelancing platforms.

- Budgeting Apps: Use real-time trackers to monitor variable spending.

Conclusion

A clear, data-driven analysis transforms your budget from reactive to proactive. By realigning spending categories, automating savings, and trimming non-essentials, you can eliminate deficits and gain financial confidence. Start implementing one change today, track your progress, and watch your balance—and peace of mind—grow.

Leave a Reply